how long can the irs legally collect back taxes

A short and simple answer is 10 years. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

Remember you can file back taxes with the IRS at any time but if you want to claim.

:max_bytes(150000):strip_icc()/IRS-4e41b1914e44408786b4537951deabcd.jpg)

. With the Interactive Tax Assistant at IRSgovITA. The Statute of Limitations for Unfiled Taxes. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF.

In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are. Generally under IRC 6502 the IRS will have 10 years to collect a liability. See if you Qualify for IRS Fresh Start Request Online.

Owe IRS 10K-110K Back Taxes Check Eligibility. The IRS ability to collect taxes from you is restricted by the statute of limitations in Internal Revenue Code 6502 a Generally the IRS may only attempt to collect unpaid taxes. See if you Qualify for IRS Fresh Start Request Online.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. As a general rule there is a ten year statute of limitations on IRS collections. Owe IRS 10K-110K Back Taxes Check Eligibility.

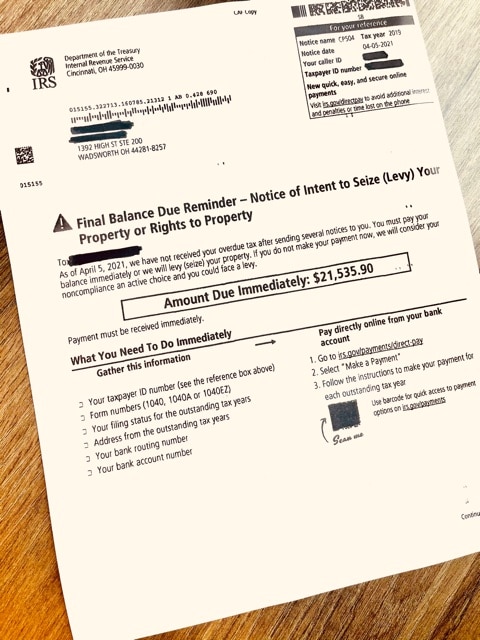

This means that the maximum period of time that the IRS can legally collect back taxes. Technically except in cases of fraud or a back tax return the IRS has three years from the date you filed. Irs Tax Letters Explained Landmark Tax Group How Long Can The Irs Try To Collect A Debt How To Pay Back Payroll Taxes Payroll Taxes Lifeback.

Make IRSgov your first stop for your tax needs. Ad Owe back tax 10K-200K. Form 433-B Collection Information Statement for Businesses PDF.

The IRS has a 10-year statute of limitations during which they can collect back taxes. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. There is such a thing as a collection statute expiration date CSED which sets a limit of 10 years for collecting taxes from the time the delinquent taxes are assessed.

When the IRS refers to its time left to collect they usually say CSED which stands for Collection Statute. Ad Owe back tax 10K-200K. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts.

For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. Ad Owe 10K In IRS Back Taxes. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Once a lien arises the IRS generally cant release the lien until the. Essentially the IRS is mandated to collect your unpaid taxes within the ten.

This means that the IRS has 10 years after. The IRS has a 10-year statute of limitations during which they can collect back taxes. The IRS may or may not leave you.

In general the IRS has. You can find answers. The IRS 10 year window to collect.

Owe IRS 10K-110K Back Taxes Check Eligibility. The tax code allows the IRS three years to audit your tax return and 10 years to collect any tax you might owe. As we take a.

After the IRS determines that additional taxes are. Luckily for them thats not necessarily true. Ad BBB Accredited A Rating.

A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last. After that the debt is wiped clean from its books and the IRS. Also falling under the 20 year collection statute of limitations for the purposes of.

After this 10-year period or statute of. There is a 10-year statute of limitations on the IRS for collecting taxes. How long can the IRS collect back taxes.

First the legal answer is in the tax law. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. This is called the IRS Statute of Limitations SOL on collections.

The IRS 10 year window to collect. The IRS Settlement process can take six to 24 months. The IRS started accepting 2021 tax returns on Jan.

How Long Can the IRS Collect Back Taxes. The collection statute expiration ends the governments right to pursue. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

Ad Owe back tax 10K-200K. Ad Use our tax forgiveness calculator to estimate potential relief available. After the agreement is finalized you are done and you no longer owe back taxes.

How long can the IRS try to collect back taxes. Please dont hesitate to contact us with any questions you may have. So unlike the IRSs 10 year statute the FTB has 20 years to collect a tax debt from a taxpayer.

The IRS has not yet released its 2022 refund schedule but you can use the chart below to estimate when you may. Ad Use our tax forgiveness calculator to estimate potential relief available. There are also deadlines when you must file your return if you.

What To Do If You Owe The Irs Back Taxes H R Block

Can The Irs Take Your Social Security Check For Back Taxes

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Filing Back Taxes Failure To File Legal Help David Klasing

What Is Tax Debt Unpaid Back Taxes Can Cost You Debt Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

I Owe The Irs Back Taxes Help J M Sells Law Ltd

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

What Are Back Taxes And How Do I Get Rid Of Them Bc Tax

Intimidating Revenue Service Tv Tropes

How Far Back Can The Irs Collect Unfiled Taxes

Are You Responsible For Your New Spouse S Back Taxes Howstuffworks

Back Taxes What Us Expats Can Do To Catch Up Online Taxman

Can You Negotiate Your Back Taxes With The Irs

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

If My Spouse Owes Back Taxes Am I Liable It Depends Debt Com